I’m not an expert on the subject. But I have been in the line of work for 35 years, and juggle these forces every day. And at the very least, your data is missing a lot of variables.

For one thing, your data is about American workers. The push for offshore software labor has only increased. And while offshore labor has also gone up, it still can be a ton cheaper than in the US, including its rate of inflation. Think 1/3rd the price of an average US engineer, or maybe 1/5th of someone in Silicon Valley. And with COVID forcing companies to be remote-capable, domestic businesses that always resisted overseas labor forces have now found it to be perfectly plausible and they are taking advantage of it. So ignoring the fact that IEEEs data on raises is barely half of what your WSJ link shows, the COVID-enabled global labor market is exerting a force that’s much more significant than domestic salary bumps.

Next, besides requiring lower “salaries”, many of these shops work on a contract basis. and so don’t require benefits. So chop another 30% off the SG&A costs required just a few years ago.

Yep, and now 4 years into COVID, many of our leases are coming due and companies are downsizing their brick and mortar footprint. Many have been making this move all along. Some big techs have dragged engineers back into the office. But many of those engineers refuse. But many firms are happy with the new arrangement, and enjoying the cost benefits.

A quick look around will also show a ton of vacant office space going for cheap.

Btw, many companies are still cashing in on PPP benefits, which is also new since COVID. These are loans that they don’t have to work hard to justify forgiveness for. The program formally ended, but they’re accepting renewals, too. It’s free money. I have no idea if Quicken is benefiting from it, but it’s very commonplace.

Anyway, like I said, I’m not an expert on the topic. But there are a couple other factors affecting my view here:

- I appeal again to history. Almost 30 years ago, I was using Quicken with nearly the same feature set. I paid maybe $25 and could use it for years, download all my transactions, etc, and only pay for an upgrade when something particularly compelling came out… or, more likely, when it was SO OLD that it wouldn’t run on the modern Mac OS. So inflation-adjust that $25 and let me walk away until I want an upgrade. But as I previously mentioned, Quicken’s feature set has been essentially flat for 30 years. We had budgets, and reconciliation, stock/investment tracking, and even CheckFree automatic free check-writing service (since removed). Since Quicken knows they aren’t providing any new value, and hence little reason to upgrade, they shifted to a subscription basis as a way to extract a new revenue stream in the absence of any new value. I have a problem with that.

- Quicken has a corner on the market. There are alternatives. But economy of scale is a huge factor here. You write code once to consume an API to fetch data in some new format Wells Fargo requires, and the cost of that engineer’s time is amortized over millions of subscribers. Independent shops like SEE Finance have to do just as much work for their tiny base. The monopolistic nature of the fixed costs of this industry stifles competition and makes it painless for Quicken to raise their prices.

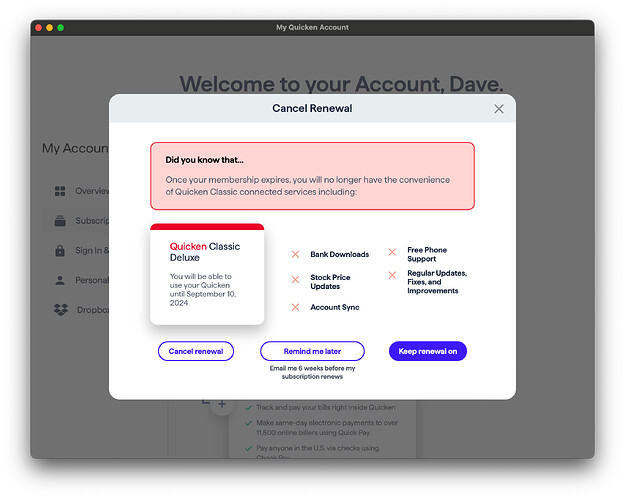

I will probably stay with Quicken for now because I don’t need another headache to worry about at the moment. But I think the fact that they already get recurring revenue from me every month is generous; and raising that 20% feels usurious.