And given their position in the marketplace where they can raise prices without much consequence, they have little reason to make the move to offshore. Businesses like most of us that don’t dominate the marketplace (or otherwise want or need to keep prices low), have to go offshore, at least in some capacity.

I made it clear that that’s not my position. If you read what I wrote, I noted a key difference between periodic paid upgrades and subscription fees.

I think I have to remind that there’s another key twist here. Before subscriptions, the software kept working long after you got free updates, possibly forever if you limited your OS upgrades. Now basic features like downloading transactions from your own bank are disabled as soon as you stop paying; it’s not just about getting security or feature updates. They break your software immediately.

If portability of data is simple and the market playing field is level, then your point is valid. But I have moved to/from Quicken in the past, and data gets lost. And if you read my earlier post, the playing field is not level. Saying “No one is forcing you to use it.” is actually the entitled position. The options for shifting are not simple.

Since Quicken is a financial tool, I’m going to put on my finance hat here. My approach to the increase, then, would be to focus on whether I think I would receive $5.99/month in value going forward and if I had a better use for the incremental $1/month in cost. While the percentage increase is indeed a double-digit increase, I’d view the percentage as more of a psychological cost and, perhaps, as an influence on my perception of Quicken Inc.'s customer service.

Unfortunately Quicken is one of the only 3 finance programs for the Mac that integrate bill pay. The other 2 are Banktivity (formally iBank) and Moneydance. Of all the rest some allow downloads but not bill pay within the program. Of the 3 only Moneydance is not a subscription model for usage but only a $24 annual fee for downloads for all financial institutions.

What all 3 have in common is mediocre support. Quicken has had a jaded history. Originally it began as a startup in offices upstairs above retail stores on University Ave. (main street) in Palo Alto and only for the Mac and was a really good program. As it grew it took on Windows and essentially abandoned the Mac and degenerated somewhat as when I was using it during that period its database would become corrupt after about 6 months. Sometime around 2010 it did a refresh and was totally rereleased as a reengineered version mostly stripped of many key features. That is when I abandoned it. A few years ago, Quicken itself was cut off from Intuit and became independent with Intuit essentially turning into a finance company making loans but keeping Quickbooks. In doing so it became much more expensive and a eventually a subscription model. Right now, its headquarters are a building on the edge of San Franciso Bay next to the major peninsula highway (101). It is also the costliest of the 3 bill pay programs and from my understanding still offers abysmal support. What if any of the previous features have been added back, I have no idea.

From my perspective its only advantage of the 3 is that it is universally supported by most financial institutions as it is responsible for the most commonly used download protocol.

I first went to Moneydance but it had so many issues I abandoned it. I tried Banktivitiy for a while before it became a subscription model but the support was so abysmal and its bugs were so annoying that I went back to Moneydance that has cleaned up many of its previous issues but still offers mediocre support.

Right now, it seems the best of the 3 and the most affordable. Its database is stable and while its GUI could stand some significant improvement it does work as advertised. It is also cross platform and uses Quicken protocols for some of its interfacing with financial institutions. It also, sometimes with issues, can import Quicken files. So, if you are looking for an alternative Moneydance is currently the one I would somewhat reluctantly recommend given its somewhat confusing interface till you become familiar with it and its often-mediocre support.

One of the positives about Quicken that I didn’t mention are the regular upgrades that we get. That gives me confidence that the software is here to stay. It took a while to learn the new ways to make reports, but I feel confident in quickly getting the reports that I need. We don’t use bill pay, but it’s something worth investigating. The amount of time that I have saved over the years by sticking with Quicken is huge. I hope that they do very well and flourish and prosper. In my opinion, it is too bad that Quicken was abandoned for quite a while which splintered the market. My hat is off to the current developers who have brought Quicken back to life, hopefully have learned from its brush with death.

In my experience one of the reasons that frequent updates happen to software, especially after release of an upgrade or significant update is to fix bugs often not discovered by the vendor due to a lack of proper SQA before release, Instead they rely on users that paid for the software to report bugs that should have been fixed before release, effectively making paid users volunteer beta testers instead of spending the time and their resources to fix most bugs, especially level 1 and level 2 bugs before release.

Good point. I have edited my last message to read “regular” upgrades.

Happily, Quicken has been remarkably stable after every upgrade.

![]()

Doug

Of course! All data is flawed to a greater or lesser degree. The data we have, imperfect as it is, nonetheless suggests strongly that Quicken’s price increase is right in line with inflation in general and in wages & benefits (tech workers included). Absent data that shows something different, I’m going to draw my conclusions from what we have rather than what we don’t.

Well, wait, now I’m confused. Do I have to allow for the offshoring in my data or not?

Note finally that Quicken raised its prices in line with inflation, not above it. They’re essentially charging you the same price they were in 2020, not doing the kind of revenue-seeking that they apparently could.

Quicken – and the other finance apps – also have to keep up with changes the apps and security systems the banks use, and sometimes it takes weeks for them to catch up, which can be a pain. Any financial software that interacts with other institutions must keep up with changes made in other software used by the other institutions.

Although I don’t like subscription plans, Quicken does keep updating their software, although part of what they’re doing is reviving features that got lost when they had to rewrite the app. (I used Quicken 2007 for a dozen years before updating cautiously.)

All in all, I find Quicken essential. I’m self-employed, we have retirement income, investments, and other outside income, so our finances are complex, and I find myself checking our income, expenses and overall cash flow frequently in Quicken. I use Moneydance as treasurer of a very small nonprofit, and it works fine for their simple operations. But I can’t imagine using Moneydance for my own finances.

My finances are complex as well with multiple checking accounts, credit cards, assets, and 4 investment portfolios, professionally managed by financial advisors which I track. So far, I have not run into an issue that Moneydance has not been able to properly handle. That is not to say, like its competitors, it does not have any issues but I have been able to tune it for the things you mention such as tracking income, expenses, and cash flow. It did involve fine tuning some of its default reports but it was able to be accomplished.

That said, choosing a finance program is a matter of personal preference. If I was not so focused on bill pay, frankly I doubt if I would be using any of the three, I mentioned, simply due to their mediocre support. Currently Moneydance does serve my needs.

If Quicken meets your needs and you are willing to put up with their abysmal support and extravagant cost, I am fine with that. I have historically tried and paid for all three mentioned and right now Moneydance seems to me, currently the best of the three for the time being when it comes to cost, features, and support. However, when it comes to support, that is not saying much.

I initially liked Banktivity after switching from Moneydance as it was severely lacking and a bit buggy years ago. But after the absolutely abysmal support I received from Banktivity for some critical issues I dumped them and switched back to Moneydance as its functionality had significantly improved from when I first used it. It did take some time and effort to understand, tune it, and work around some of its idiosyncrasies. So, for me, for the present time, it seems to be the best value for the functionality I need.

While I have no idea if Quicken ever fixed its database corruption issues when they rewrote the program, that previous experience alone was enough for me to abandon it forever. I simply cannot begin to describe the number of hours spent on reconstructing a new database and importing and correcting six months of transactions into the new one. The only workaround I ever found was to close and archive the existing database and create a new database for current transactions approximately every 6 months.

A financial tip some might not be aware of: The cost and maintenance of a financial program may be tax deductible if its data is being used in conjunction with tax preparation. I’m not sure if this applies to EZ forms using the standard deductions, but if you itemize this could be an overlooked deduction. Of course, it is prudent to check with a tax expert to see if you qualify for this deduction as tax laws do change and given the low annual cost of Moneydance I have not claimed it in years.

I use reports heavily, and Quicken meets my needs much better. But I have to admit that I never really tried to learn all of Moneydance’s capabilities. And while I did have significant problems transferring from Quicken2007 to the current version, they did not come close to yours, and for a while Moneydance could not directly download from that bank account, which I only recently solved. I use TurboTax for my taxes. I understand taxes fairly well because I worked at H&R Block one tax season long ago, but using the software is much easier than doing it myself.

While we’re grumbling about Quicken, I just tried to log in to my account and when Quicken opened it tried to force me to “synch all my accounts” from Quicken Classic. I don’t have other accounts, and I don’t do any mobile banking, and I don’t want my account on the web. The page where I get dropped after I log in (Quicken Classic - The simple way to stay on top of your finances) does not offer any other way out of that page. I was able to get around that by logging out, opening a fresh quicken.com page, go to support, and log in through there. But I am not happy with this attempt to force me into creating parallel accounts without an explanation what it is supposed to accomplish, or what it gains me if I have no need for them.

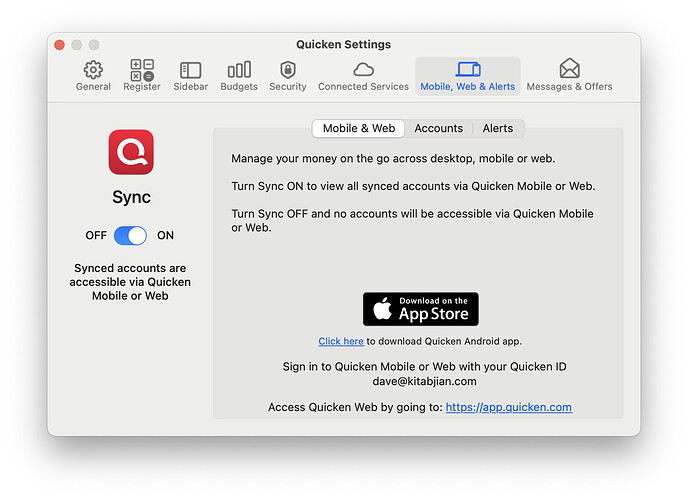

You can disable the mobile/web feature which should keep your data (more) private:

I should probably disable mine, since I find the feature useless for my purposes, because it only retains a limited amount of history. So, for example, running any annual reports or searching for a transaction more than a few months old will not return useful results.

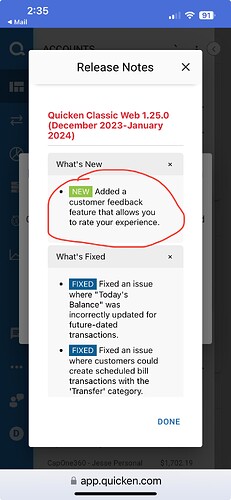

Still, I tried to log into that page you linked to see what my experience was, and found this new feature that you might find helpful ![]()

This thread and its descriptions of the options available for personal finance management software have led me to think about the size of the market for these programs. I don’t follow the category that closely but it seems like the user base is either static or shrinking. Even fintech startups haven’t been able to create any momentum or hype.

I wonder if this means a lot (most?) people don’t track their finances closely these days or if it means most people are no longer using “legacy” financial institutions to hold their money and assets. Either possibility has a lot of implications for financial markets and the economy going forward.

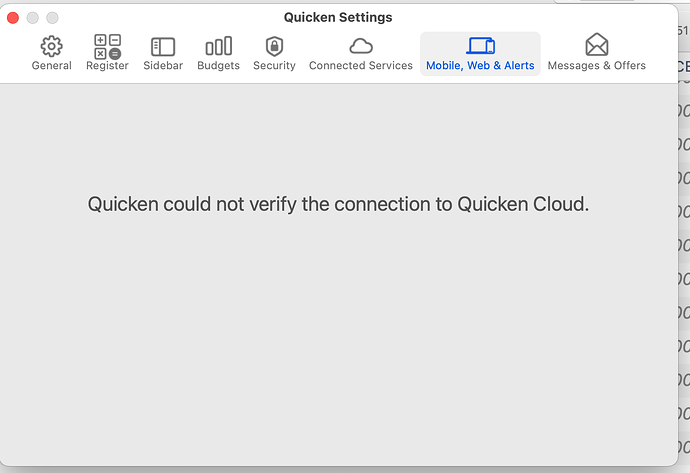

Thanks. That’s interesting, particularly because what I see when I look at the same Settings page is

So it looks like to be able to turn off this Sync feature you have to sign into it. Rather annoying from my viewpoint.

I don’t follow your logic. What I see is that the “FinTech” – financial technology companies in the current lingo – are trying to pull customers into mobile and web services. I’m dragging my feet very hard on that because I find mobile very difficult to use because of my aging eyes, and because my experience with hacked credit cards makes me very wary. They’re also trying to introduce new products that will make it easier for customers to get trapped into paying them interest, as credit cards do today.

Personal finance software market (by this I mean tasks such as bookkeeping, report generation, and maintaining a check register, not new ways to invest nor new ways to borrow) now composed of fewer than 5 major players with Intuit divesting Quicken a few years ago => No new entrants to market over past few years that have reached mass scale or profitability, either from large players or small players => Could be an indicator that the market size for Quicken-like software is static or shrinking => Fewer participants in traditionally regulated financial services means less oversight, reduced consumer protection, and higher volatility in asset values

Thanks for the explanation. That makes sense. I think what Quicken is trying to do is to move beyond the traditional bookkeeping functions. As it happens, I’m not interested in mobile banking because it’s a lot easier for me to work on a large screen, but web banking does make sense for users of mobile payments. And they’re fishing around a lot to find more Fin-Tech applications.

Fascinating question. My kids are still young adults, but they all have bank accounts. They use the mobile apps. But none of them even has check writing capability. Debit cards get the job done, and they can be linked to Apple Pay. And while I feel somewhat delinquent as a parent saying this, none of them have been taught to balance their monthly statement. Of course, I stopped doing it myself years ago, especially since I have so many accounts that it’s impossible.

But anyway, Quicken emerged in a world where there was no (popular) Internet, and certainly no online banking, ability to download transactions, or web or mobile apps to track or search for charges. The latter features solve the needs for many young adults that were traditionally only available via Quicken.

So the incremental value of Quicken, like running more sophisticated reports, especially over years of transactions spanning multiple accounts at various institutions, tax tracking, etc, is probably a substantially smaller market. Certainly none of my kids use it, and I’d be surprised what % of Americans in their 20s use Quicken or anything like it. I’d guess <3%. But I’m curious!

I agree with you. Virtually everything these days is being pushed to using apps and I hate using apps on a phone. I recently wanted to arrange auto payment of a credit card - from an account with the same bank - through internet banking on their website. It simply said it couldn’t be done ‘online’ but could be done on their app. Very frustrating.

I’d like to see Apple devoting more effort into allowing iOS apps to run on Macs - that would make the entire thing slightly more palatable.