I HAVE SO MANY THOUGHTS ON THIS TOPIC, I’m sorry sorry for continually necroing it!

Moneydance is my “It’s ALLLLLLLLLmost great” choice from among the single-entry “checkbook register” programs; Banktivity is in this category too. I like much about the UI (although Moneydance’s split-entry UI is super-overloaded and IMO confusing). But all of these programs suffer from the same problem, which is that checkbook-register accounting is inherently error prone and, once you’ve made a mistake, is difficult to recover from. I can’t count the number of times I began using a new personal finance program in earnest and then, 18 months later, realized my books were garbage and had to effectively pick a new “day zero” to fix things up. (Having used double-entry for years now, I’d estimate that my “error rate” is about one mistake, per account, per month. So any software that doesn’t help me find those mistakes IMMEDIATELY is software that is causing more problems than it solves.)

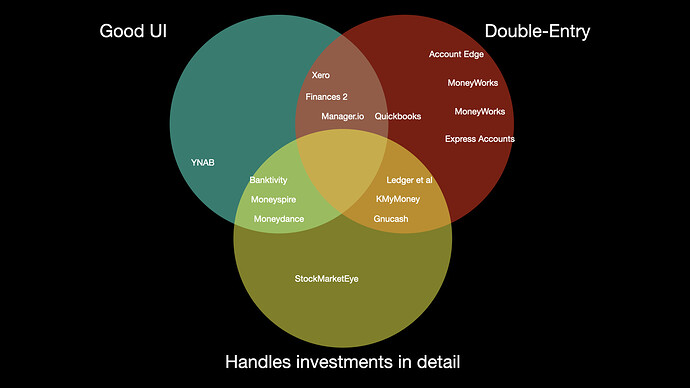

So you want double-entry, because if your finances are sufficiently complicated it’s a requirement to find your mistakes. But, none of the double entry programs do a great job with investment accounts. So basically you’re faced with this Venn diagram, and there is nothing in the intersection of all three circles: