I’m glad you called out the feature of sharing your account with your financial advisers—that could save time in generating reports, make the accountant’s life easier, and reduce costs by streamlining the entire process. Since we’re pondering switching to a different accountant this year, having them familiar with Xero might be a big win.

FWIW they have an accountant finder tool, if you don’t know someone who works with Xero through your own word-of-mouth network: Xero Advisor Directory: Find Accountants, Bookkeepers & More | Xero IE

The real elephants in the room with Xero is trying to download all your data and making a proper backup.

To my knowledge there is no easy and simple one-click way of making a backup directly in Xero. And should Xero go “pop”, and we have seen that with companies, then so does all your data and financial records.

Not a good thing and I am sure my tax office would take a dim view if I said the equivalent of the “dog ate my homework” (i.e the software company took my data).

So I use https://www.getboxkite.com to automatically download backups of data and invoices etc etc from Xero to my Dropbox.

Anyone moving to Xero should budget for, and use that service – or one of the similar ones that are offered.

I’m curious what you see as the disaster situation here, and how you’d use the backup that these services would provide. For the most part, Xero is just pulling data in from other accounts, so the backup would largely involve categorization of transactions, at least for us (since we’re not doing invoicing or billing in Xero).

So if Xero goes under as a company and millions of people were forced to switch to some other service, it’s not entirely clear to me how useful data exported from Xero would be, beyond lists of contacts and a chart of accounts. The other service would still have to connect to all your accounts and pull the data in from them. Perhaps it would support importing the Xero data, but that seems like a big assumption to me.

If the disaster scenario is instead that Xero has somehow deleted all your data, having a backup might make it easier to import data back into a fresh Xero account, for sure. However, in that case, I think I’d be very leery of continuing with Xero and would be looking for an alternative immediately.

When we switched from AccountEdge to Xero, the only thing we imported was our chart of accounts with starting balances. Admittedly, that was at the start of the year, so we were starting fresh. But having other data in AccountEdge certainly didn’t help us in any way.

I run a small business and I use Xero as a full accounting package dealing with invoicing, billing, VAT (a UK sales tax), payroll etc. Unless you are meticulous in keeping records and copies of all the receipts, invoices etc before they are entered into Xero then you are relying on Xero keeping all of these records secure. In UK law you (not Xero) are responsible for keeping full tax records for (I believe) x7 years and that includes copies of all receipts, invoices, expenses claims, bank account records, VAT returns etc.

Now, Xero say in their T&Cs that you are responsible for maintaining backups of records (https://uptakedigital.zendesk.com/hc/en-us/articles/360000096036-Do-I-need-to-backup-Xero-). Yet Xero gives you no easy “one click” way to export all your records. You have to do lots of exports: Xero Central

If Xero were to fail, go bust or disaster should strike, and all my data in Xero were to disappear, then UK tax authorities would say that liability for my records lies with me. Which is why I use the third party backup service that I previously mentioned as this backs my data up daily in a way that another accounts package or accountant could easily work with.

Yes all the original data my still be found in lots of different places, but Xero is where all my receipts, expenses, bills were uploaded, and that is where I generate my tax returns, VAT returns and invoices etc. So I am amazed that Xero does not offer a simple built in way of backing up all my data I have entered in an easily accessible form and I am surprised that you seem “relaxed” about this – I thought your data was only as good as your backups

It does sound like backups would be vastly more important for a business that was using as much of Xero as you are. In our case, Xero has very little unique data since it’s just reading the data from the actual sources, which would remain accessible. If we were forced to switch to another accounting package tomorrow, it would be annoying, but with a chart of accounts and recent account balances, it wouldn’t take long to bring it back into sync. It sounds like that would very much not be true for your business.

From what you’re saying, the key for Xero backups is to make sure they’re being made in some sort of format that could be imported into a different accounting package. Perhaps I’m as “relaxed” about this as I am because AccountEdge did nothing more to help us in that regard—we switched to Xero with just the chart of accounts and opening balances.

This is a topic near and dear to my heart, @ace. In the past year, I have used just about every major and most minor bookkeeping packages for MacOS, as well as a few cloud solutions. I’ve been thinking about Xero (as well as waveapps) but haven’t made the leap yet.

I agree with your assessment of AccountEdge - it’s very 1990s, and just so clunky. For my personal finances I live on GnuCash, which is also clunky but allows me to keep everything offline. I also had a brief flirtation with the “plain text” accounting programs ledger and beancount, but disliked how unstructured entering data was.

I have been thinking long and hard about the cloud issue. It’s certainly true that the cloud luddites (I’m one!) tend to be individuals - businesses, by and large, have flocked to the cloud in droves, so I think this may simply be a case where we as individuals are magnifying the risks past what they actually are.

Lately I’ve been experimenting with manager.io (in fact, I just made a video about it), which is a multi-platform package that supports both cloud and local use. Like Xero, it’s very focused at business. Unlike Xero, it doesn’t have the tight integrations to banks. I suspect that once you’ve gotten used to those integrations, going back to a package without them is going to feel like lighting a fire by rubbing two sticks together.

It is not unusual that double entry accounting programs don’t have good support for investments - GnuCash is really the only one I can think of with first-class support, and even there you run into the impedance mismatches between how we as individuals want to think of our investments (“My BIGCO shares are worth $50,000!”), and how the ledgers want to think of them (“You paid $200 for your BIGCO shares, so that’s what they’re worth.”)

Thanks for the deep dive into your migration to Xero! It gives me a lot to think about.

Sounds like you’ve put a lot of thought into this indeed, @peterb1! I hadn’t heard of manager.io before, but it looks like it might be a good alternative for those who were using AccountEdge and want to stay off the cloud.

I will say that since I wrote this article, I’ve continued really liking Xero. The reconciliation aspect is just so satisfying.

The real question I have is why is it so impossible to port data from one accounting package to another. We have the .qbo format, but it’s fairly primitive. There should be a portable document format that all of these types of software adhere to. I guess the incentives align against it, though.

I HAVE SO MANY THOUGHTS ON THIS TOPIC, I’m sorry sorry for continually necroing it!

Moneydance is my “It’s ALLLLLLLLLmost great” choice from among the single-entry “checkbook register” programs; Banktivity is in this category too. I like much about the UI (although Moneydance’s split-entry UI is super-overloaded and IMO confusing). But all of these programs suffer from the same problem, which is that checkbook-register accounting is inherently error prone and, once you’ve made a mistake, is difficult to recover from. I can’t count the number of times I began using a new personal finance program in earnest and then, 18 months later, realized my books were garbage and had to effectively pick a new “day zero” to fix things up. (Having used double-entry for years now, I’d estimate that my “error rate” is about one mistake, per account, per month. So any software that doesn’t help me find those mistakes IMMEDIATELY is software that is causing more problems than it solves.)

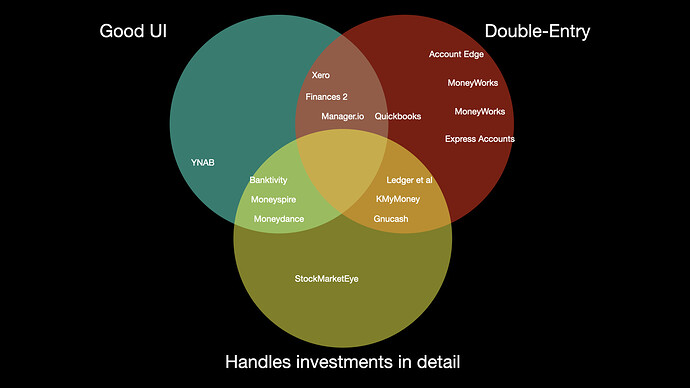

So you want double-entry, because if your finances are sufficiently complicated it’s a requirement to find your mistakes. But, none of the double entry programs do a great job with investment accounts. So basically you’re faced with this Venn diagram, and there is nothing in the intersection of all three circles:

The format is there, it’s called XBRL.

Now convince the software makers to adhere to it.

I am currently going through accounting system change in my office, from Solomon 6.15 (Windows, ancient version) to Acumatica (cloud based accounting for businesses). I’ve been through a few accounting system migrations in my IT career, but most too ancient to bother mentioning. But in every case we never ported all data, just month closing balances for the previous 2 years, vendor information, and the like. But never entries. In many cases we had to redesign the chart of accounts to work well with the new system, though also a good chance to streamline our systems. I will be so happy that I will be able to retire our single Windows server after migration is done, we will keep the old system running for 18 months for looking up historical information. Otherwise we will depending on the monthly spreadsheet exports for historical information.

ARISE, necro’d thread! Adam, I want to zero in (<— SEE WHAT I DID THERE) on one paragraph from your article:

Similarly, Xero emphasizes its bill-related capabilities, allowing you to pay one-off or repeating bills and track the payments. These features don’t help us because we pay all bills on time via a credit card or automatic bank withdrawal, and we don’t use special bill-tracking features.

I bit the bullet and signed up for Xero and have spent the last month exploring it. There is actually a way to leverage the invoice/bill workflow in a way that will help you, even in your “Early” plan. It has to do with the free Hubdoc subscription they give you.

So just to recap, reconciliation on Xero matches transactions you enter into the system with the transactions that come from your bank feed (or OFX import). Probably right now, especially for the Apple Card transactions, Tonya spends time matching transactions or else entering the data anew with the bank feed/OFX transactions. Just about every time I go to reconcile I think to myself “I think I created most of the transactions I needed to know about”, and every time I am wrong.

The trick is that Hubdoc, in addition to letting you generate invoices from OCRd receipts, will also generate payments. So now for 90% of my transactions, the workflow is:

(1) Buy a thing.

(2) When the receipt shows up in my email, forward it to a special address at Hubdoc (which has already been connected to Xero). Forget about it until later when I can log into hubdoc and do a bunch at once.

(3) When I start looking at the forwarded receipts, Hubdoc pulls out about half the info I need (notably usually the total spend, but often the vendor name, etc).

(3)(a) If this is the first receipt for this vendor, I have to enter a little bit of Xero-specific data (what account to charge it to etc)

(4) Click “Publish”. The transaction goes into my Xero ledger without my even having to log in.

For future transactions from the same vendor, you don’t even have to enter the Xero-specific data, because Hubdoc remembers the settings for last time.

When the transaction comes in from the bank feed or OFX, the matching transaction is already entered, and you just click “OK”. And as a bonus, your original receipt is attached as an image. This workflow is clearly “meant” for invoices and bills, but it works just fine for normal payments, and using it has substantially decreased my error rate (in part because the receipt in question is actually on the screen while I’m categorizing it, so no looking back and forth between windows or the like).

Hope this helps!

Interesting! Kudos on the research here, and thanks for all your input into this topic.

You are correct that I download the Apple Card statement from Wallet every month and then import the OFX into Xero. It’s more annoying than a linked account, but not terrible.

(I export from Wallet into a Google Drive folder using Files, and then Google Drive Desktop on my Mac brings the file to the Mac where I can import easily. The hardest part is renaming the file since Apple’s default naming wouldn’t sort reasonably: they use Apple Card Statement - October 2019.pdf and I change that to 2019-10 Apple Card Statement - October 2019.pdf.)

What I’m not quite understanding in your Hubdoc technique is what that gets you beyond what the OFX export/import provides. That’s likely because we use the Apple Card pretty much only for purchases from Apple, so it gets Apple Music and iCloud+ and any hardware purchases we make. Since the payee is always the same, I’ve had to make rules to say that $14.99 goes with Apple Music and $9.99 goes with iCloud+, but then it’s just a matter of clicking OK to reconcile the transactions.

So if I’m guessing correctly, your Hubdoc technique would provide additional information for Xero to recognize transactions more accurately than it does on its own? We could theoretically use that with our business Visa card, which is imported automatically. I haven’t felt like I was doing an unreasonable amount of categorization on those transactions—the first one is always an issue, but after that, Xero remembers them. Even there, most of them are recurring fees like our hosting bills and software subscriptions.

I’ve had that naming issue too, and I wish they would fix it (and/or provide bank feeds, but baby steps I guess…)

The technique I’m proposing isn’t actually life-changing, but more of a linear quality-of-life improvement. Pre-hubdoc, my flow for the Apple Card looks like this:

(1) Download transactions at end of month.

(2) Import OFX to Xero.

(3) Look at each transaction.

(4) Click “Ok” for the recognized easy repeating transactions.

(5) For the remainder, find receipt and/or remember what it was, and ‘code’ it to the right account.

If all of your transactions are already recognized by Xero, then I don’t think Hubdoc gets you much more on top of what you are already doing.

For me, however, although many of my transactions are repeating, enough of them are left over after step (4) that step (5) is annoying - I have to go find the right receipt at worst 29 days after I generated the expense. With hubdoc, the flow looks like this:

(-1) As I generate an expense, forward the receipt to my hubdoc email and forget about it.

(0) Right before reconciling, code the receipts in hubdoc. You don’t have to go looking for the receipt because it’s right there on screen.

(1) Download transactions at end of month.

(2) Import OFX to Xero.

(3) If you did it right, every transaction in Xero is reconciled by just clicking “ok”, because it’s already coded.

The one other thing hubdoc does that doesn’t matter much to me but is important to some businesses is extracting exactly how much tax was paid on a given receipt. But for me the secret sauce is mostly just the convenience of having the receipt in front of me while I’m coding it and pulling out the business name automatically.

I would use a Folder Action for this. (Select a folder and choose Services > Folder Action Setup… from either the Finder menu or the ctrl-/right-click contextual menu.) You’ll need to create a script to do the renaming, how you do this depends on what you’re most comfortable with. It could be done in pure AppleScript, or you could call sed from the script, or any Unix scripting language.

Once you have your script and set it up as a Folder Action on the folder in Google Drive, whenever you add a file to the folder by exporting from Wallet, the script will run and automatically rename it for you.

Good! I see what you’re doing now, and I think it’s a clever approach. It isn’t likely to help me much due to how we use the Apple Card, but I think others could very much benefit from it.

Doh! Of course. I’d probably do this with Hazel, which is what I tend to rely on for folder-based stuff. I hadn’t even thought of it because I’m starting the process from Wallet on the iPhone and saving to Files on the iPhone—I wasn’t thinking of it as a Mac task. I hadn’t even thought about using Shortcuts (and now that I look, it doesn’t tie into Shortcuts at all).

This is definitely a deal breaker for Account Edge. Thank you so much for pointing this out.