Originally published at: Melio Makes Payments for Small Businesses Easy - TidBITS

Faced with the desire to make it easier to pay TidBITS writers every month without a regular fee, Adam Engst discovers Melio, a payment service that offers ACH-based payments for free.

PayPal is very expensive way to send money across currencies or borders. If you need to do this in the future, I recommend Wise (that’s my referral link which gets you your first transfer for free). Their rates+fees are generally the best you’ll find, and the interface is excellent. I’ve been using them for many years (they were formally called TransferWise). And don’t be fooled by ‘no fees’ from PayPal and similar – it’s all in the ridiculous exchange rate they use!

Looks some general improvements are in the works, though it could take a few years even barring politics. The FedNow instant payment system is in active pilot mode:

“Fed’s new instant payment system could be trouble for PayPal, Venmo”

Oh, interesting. I wonder if @kirkmc has run across them before, since he deals with this a lot.

Someone like @kirkmc (frequently dealing with multiple currencies) might also find the Wise account useful – it provides local account details for several countries (US, UK, Eurozone, etc.). So people in those countries can make transfers to your account as if it were a domestic transfer.

I second this, wise.com is the best option by far for international transfers. Depending on the currencies involved many (but not all) transfers are also instantaneous these days. I’m a freelancer myself but a translator, and international transfers are a frequent need in this sector.

The FedNow system seems like it has potential, but it requires the banks to build the tech into their portal to allow business payments to be made faster. I think the only business payment provider in the USA that currently offers instant payments to businesses is Forwardly. They were at Scaling New Heights last month and had just launched before the conference. They can’t do cross-border yet though, it’s only domestic.

I also recommend Wise. Much cheaper than PayPal for international payments.

Another vote for Wise here. Covers the major currencies, not much use for local currencies in Africa or Asia. Use the right transfer method and you’ll not pay more than around $3 in fees, exchange rates are usually very close to mid-market rates too. All you have to decide is which currency the transfer is made in as USD and GBP accounts are available. We use it for holiday payments in local currencies that we change into GBP our end. Your payee may not be happy with the exchange rate risk in receiving USD payments.

This whole payment system sounds overly complicated, as a UK citizen.

Over here, someone emails you a pdf invoice with a reference on it (eg. “Invoice 1234”) to pay, listing Account No, Sort Code (aka Routing No, in the US), plus Bank Name. The payer then just logs into their online banking, adds those three details and a reference note (eg. “Invoice 1234”, so both sender and recipient knows what the payment is for) into a Make Payment screen, and hits the Pay button. The recipient’s details are saved for future payments, and you just change the reference note on subsequent payments to a new one (eg. “Invoice 4321”).

These payments are all free, go over an inter-bank system called FP (Faster Payments) to hit recipients account within 2-hours, with most banks accept upto £20k via this method. There was an older system called BACS which did the same thing for free, but took upto 3-working days.

I suppose most US folks don’t have such free conveniences, even in the 2020s, which is quite weird.

+1 for WISE. I also use it in the US for purchases using direct payment. Better than Zelle, or at least less fraud potential. I use it for several currencies, and am just now in the UK (which is Not Europe, and don’t you forget it!) and the Eurozone. Later this year for Turkish Lira. The dynamic quality, that is the ease with which you can move from $s to € to New Turkish Lira or whatever means that you needn’t get stuck if the dollar (my home currency) plunges against the Zloty or whatever. In the past I lost some money in euro and pound accounts so I am shy. Wise is great! Also pretty good customer service. ATM use is a bit expensive IMHO. Visa card use is really a top-up service: you can spend what’s in an account. The derisive remarks about the US payment options in the 21st century are entirely deserved. But things like WISE compared to the gyrations of getting money in London (not to mention Syria, Yemen, Egypt and elsewhere) used to be insane. Now—not so much. BUT phone service—no top-up accounts for Apple’s 14s, that have only an eSIM: the provincialism of Apple is legendary.

Yes! As an expat living in Sweden, I’ve found wise to be extremely valuable, especially for international travel. You can set up over 50 different currencies in your account, and use their (inexpensive) Visa card. Wise automatically draws from the currency offering the best exchange rate if you don’t have enough of that countries currency in your account)!

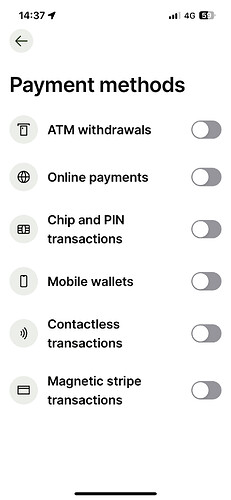

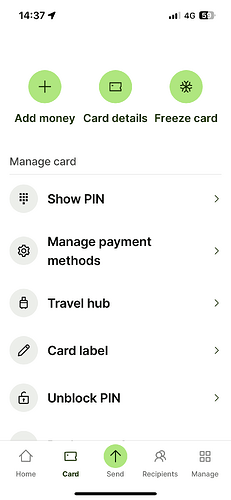

Lots of praise for Wise here. Don’t think anyone has mentioned that they also offer (multiple) digital as well as physical Visa cards. Both the physical and digital cards also have multiple settings payment methods.

This is what FedNow will be, assuming it achieves escape velocity. I hope it does.