Originally published at: Apple Card Moving from Goldman Sachs to JPMorgan Chase - TidBITS

In the Wall Street Journal, AnnaMaria Andriotis and Gina Heeb write (paywalled; Apple News+ link):

JPMorgan Chase has reached a deal to take over the Apple credit-card program from Goldman Sachs, according to people familiar with the matter.

The biggest bank in the country will become the new issuer of the tech-giant’s credit card, one of the largest co-branded programs with some $20 billion in balances, in a deal that has been negotiated for more than a year.

The deal, which is expected to be announced soon barring any more last minute hiccups, will further cement JPMorgan’s status as a behemoth in the credit-card sector and marks the final chapter of Goldman’s failed experiment in consumer lending.

It was only a matter of time before Apple found a company to replace Goldman Sachs, which has been trying to exit consumer lending since 2022. The Wall Street Journal reports that Goldman has lost over $7 billion since the beginning of 2020. Apparently, the deal with JPMorgan Chase took so long to negotiate due to “a high exposure to subprime borrowers and what has been a higher-than-industry-average delinquency rate.” I wouldn’t have expected that of the Apple Card.

JPMorgan will reportedly issue Apple Cards to new and existing cardholders, suggesting we’ll see new cards arrive in the mail, though the transition will take some time. JPMorgan also plans to open a new Apple Savings account, and existing Apple Savings account holders with Goldman can keep their accounts or open a new one with JPMorgan.

After the Wall Street Journal article was published, Apple released a statement and FAQ about the transition. The takeaways are:

- From Apple’s perspective, it’s “Chase,” not “JPMorgan Chase,” presumably because Chase is the consumer and retail banking side of the company and the brand that cardholders will see.

- The transition will take place in approximately 24 months, so nothing is happening anytime soon.

- Apple Card policies and programs will remain unchanged: no fees, Daily Cash awards, Savings accounts, and Apple Card Monthly Installments. Mastercard will remain the payment network.

- Given Apple’s carefully worded non-answers in the FAQ, it seems likely that Apple Card numbers will change and new physical cards will be required, with details being communicated as the transition date approaches.

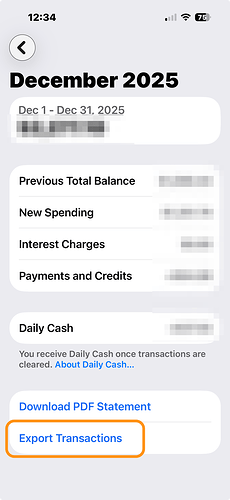

Our main hope for this transition is that Apple will allow Chase to enable access to Apple Card account data through financial management apps and services, as with most other credit cards and bank accounts. It’s frustrating to hear Apple crow about the Apple Card’s ease of use on the iPhone while requiring users to download statements for import into apps like Quicken Classic and Moneydance.